Excel payroll templates help you to quickly calculate your employees’ income, withholdings, and payroll taxes. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats. A payslip template is formal document which is given to employee along with his salary. It is very beneficial for employee as it helps him to make sure that he is on the right tax code, right amount has been deducted as tax, what amount has been earned by him.

There are an array of online templates in excel which will take care of all your salary slip needs. For a more advanced computer user who knows how to effectively use excel programs, this is truly the best option. It looks great and you can use it anyway you want.

How To Make A Payslip Template?

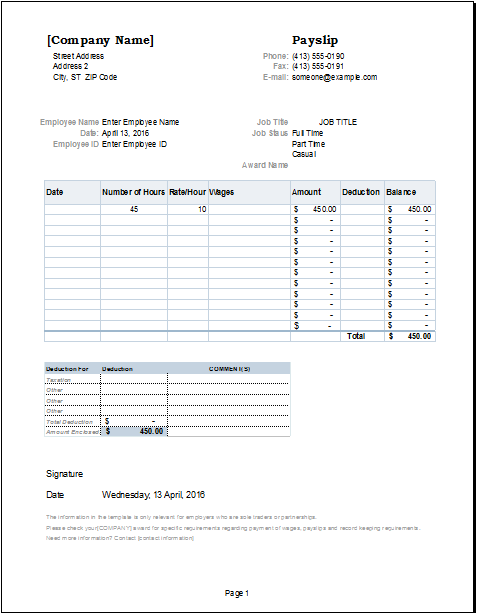

You need to download and fill out vital information in various categories. Choose as many categories you plan to include. However, there are some headings comprising of the very basic details that will be required for proper documentation. These include: employee name, employee ID, pay period, tax and other deductions, bonus etc.

Step 1. Include General Information

Firstly, you need to ensure that you fill out the company details such as company name, address, location and phone number. Then, you could specify the department for which the employee receiving this income slip, is working in.

Step 2. Include The Pay Period

This is a really important section on the salary slip template and is the one that requires constant updating. The “Start Date” is the date on which the pay period started. Thus, if you are paying an employee for working for the past two weeks, note the date that started two weeks back. The “End Date” is the end of the employee’s pay period. It is commonly set for the 7th or the 15th or the 30th of each month. The end date is also referred to as the pay date. It is the date on which a check or any other payment method is being issued to an employee. This will be the same as an “end date” or one or two days ahead or behind.

Step 3. Include Vital Employee Information

Typically, there are two pieces of information that you will need to fill out about the employee. This includes the employee’s name and the employee’s id. You need to ensure that you use their full name when specifying their details. It is a good idea to allot an employee id. This will make it easy to allocate a standard and quicker reference to the employees.

Weekly Payslip Template Excel

Step 4. Include Crucial Tax Data

This section will only show very general information as to which taxes are being paid. It will record your salary related tax filings. Depending on your individual current tax situation, you may want to claim a few exemptions or withhold an additional amount from going towards taxes. Thus, if for instance, an employee is planning to donate a portion of their salary towards a charitable organization, it does not become tax deductible. Instead, it may become eligible to claim an exemption in advance. Otherwise, every employee will be taxed at the prevailing tax system rate. For various tax related matters, it is a good idea to hire the services of a knowledgeable accountant for professional advice!

Step 5. Include The Employee’s Earnings

Weekly Payslips Templates Microsoft

Earnings can take various forms. However, the most common headings are as follows:

1. Regular Salary: This includes the regular salary earned by an employee through hours worked during a specified pay period.

2. Bonus: Although, every pay period does not include a payout in the form of a bonus, it needs to be marked separately in a period where the bonus is paid.

3. Awards: If your organization declares monetary awards during the year which recognizes some extra efforts or other outstanding achievements, you will be required to record it.

Step 6. Include The Employee’s Salary Deductions

Weekly Payslips Free Templates

Of the total earnings that any employee has earned during a specific given period, not all of it is taxable. Some of these earnings that go towards employee 401K plan or healthcare insurance, are not taxable. These earnings are called deductions. A qualified accountant will tell you what qualifies as a deduction and what does not. While calculating the taxes, you should first subtract various deductions from the total earnings.

Weekly Payslips Templates Excel

Step 7. Calculate The Net Pay Distribution

Weekly Payslip Template

This is the amount an employee will receive from the company during a specified pay period. It is calculated as net pay of an employee which is the total earnings less the total deductions less the total taxes. An automated template will begin calculating the total amount earned by an employee. Next, the template will subtract various things that immediately come out of these earnings such as the employee’s contribution into a health insurance plan and the 401k plan. Also, it will subtract the amount of money, this employee has been paying towards taxes. If your company is paying through direct deposit, it is a common practice to mention the last few digits of the account, the money is to be deposited into.

There are certainly several other types of earnings which may apply to your kind of business. Hence, it is necessary to customize and add additional categories other than the ones that have been already included, in a template.

Weekly Payslips Templates

Payslip For Employee Template!

With advances in technology, most of the templates offered these days, are really good. These days, a large majority of organizations pay their employees and show records in ready slips. Regardless of whether you are required to pay a domestic worker or your workers in overseas offices such as Malaysia, South Africa, Australian markets etc, these can be easily put to use.

Pick the most appropriate salary slip template by downloading the file and reading the instructions. After you have selected a specific template, carefully go through the brief but important instructions that tell you how to fill and use them. There are a wide range of software options that are available for automating your income slip template.

Understanding a few of the most commonly used terms for a salary slip, is vital. This will help you to fill out the slips accurately and quickly. Although there are several pieces of information that you could use for filling up the income slip, you could customize and focus on the key basic details that you would like to include.

So that’s it, by including few critical details in the salary slip template, you can easily put together a comprehensive income statement. Hopefully, this will be just right to ease your human resource work and get you going into the right direction!