- Advantages of wealth maximization: Wealth maximization is a clear term. Here the present value of cash flow it taken into consideration. The net effect of investment and benefits can measure clearly. (quantitatively) It considers the concept of time value of money.

- Profit maximization and wealth maximization. Table 1-1 summarizes the advantages and disadvantages of these two often. Advantages Dis advantages Profit maximi. Wankel received his first patent for the engine in 1929. He began development in the early 1950s at, and completed a working prototype in 1957.

- May not give the value-maximizing decision when used to choose projects when there is capital rationing 4. Cannot be used in situations in which the sign of the cash flows of a project change more than once during the project's life Modified Internal Rate of Return Advantages Disadvantages 1. Tells whether an investment increases the firm's.

- Advantages And Disadvantages Of Profit Maximization Pdf

- Advantages And Disadvantages Of Profit Maximization Pdf Download

- Advantages And Disadvantages Of Profit Maximization Pdf Free

Various advantages of Customer Retention are as discussed below: –. Cheaper than Acquisition: Foremost advantage of customer retention for every organization is that saves the cost involved in acquiring new customers. Customer retention is five times more economical than the acquisition process and thereby a most cost-effective method of. Value Maximisation Model: Value of the firm is measured by calculating present value of cost flows of profits of the firm over a number of years in the future. To do so profits of future years must be discounted because money value a rupee of profit in a future year is worth less than a rupee of profit in the present.

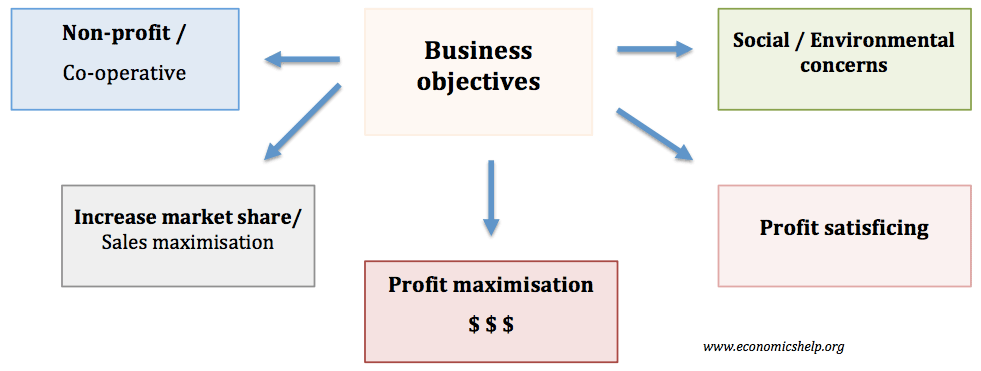

Profit maximization is one of the many goals of financial management. While earning a profit is the goal of every business, profit maximization in financial management can put too much emphasis on profits and not enough emphasis on other aspects of the business such as customer retention, social and economic well-being, and other goals and aspects of the company.

If profit maximization in financial management is a major goal of your business, it’s worth looking into why profit maximization has some limitations and why it isn’t always the best route to take when it comes to meeting the needs of your company.

Limitations of Profit Maximization

Advantages And Disadvantages Of Profit Maximization Pdf

Long-Term Sustainable Goals

Profit maximization might be one of the top goals of financial management but this type of practice doesn’t imply that short-term profit increases will help produce long-term sustainable goals for the company. While profit maximization in financial management has the potential to bring in extra money in the short-term, long-term earning could be drastically diminished.

Lowering production quality for the sake of increased profits will hurt your brand, upset customers, and allow competitors to steal your business. For instance, if your organization decides to unload all available inventory to a demanding client, you’re only alienating loyal clients who would have spent more over time. When it comes to profit maximization in financial management, it’s important to understand if your short-term profit maximization efforts will lead to long-term sustainable goals.

Product Quality

Another limitation of profit maximization in financial management is the potential to decrease product quality. Earning higher profits might be one of the goals of financial management but cutting corners, using lower quality materials, and sacrificing company values to earn a higher profit will affect the reputation of the company and potentially lose customers.

It’s easy to force your employees to work harder without any pay raises or use environmentally damaging products to cut corners and maximize profits but cutting corners is the best way to ruin your brand reputation and cause the company to fail. While profit maximization is a major goal of financial management, it’s best to not cut corners or compromise company values to earn a few extra bucks that could cost you your customers and business.

Employee Training

A great way to reach profit maximization in financial management is to cut employee training or the research and development budget. While this will reduce operating expenses, and maximize short-term profits, it will not help the company reach any long-term sustainable goals and could even potentially cause employees harm. Employee training is essential for any company looking to maintain long-term profits while creating happy employees. Without a satisfied workforce, your company will fail and any corners you cut to maximize profits will not have been worth it.

There are many goals of financial management with profit maximization being a top priority. It’s important to understand, though, that only focusing on maximizing profits will create business turmoil and could do drastic harm to employees, customers, and the business as a whole. The best way to successfully reach profit maximization in financial management is to focus more on company integrity and long-term, sustainable goals. Short-term goals are a great way to meet long-term goals, but only if they have the company’s future in mind.

The objective of a Financial Management is to design a method of operating the Internal Investment and financing of a firm. The two widely used approaches are Profit Maximization and Wealth maximization.

Profit maximization: Profit maximization is considered as the goal of financial management. In this approach actions that increase the profits should be undertaken and the actions that decrease the profits are avoided. The term 'profit' is used in two senses. In one sense it is used as an owner oriented. In this concept it refers to the amount and share of national Income that is paid to the owners of business. The second way is an operational concept i.e. profitability. It is the traditional and narrow approach, which aims at, maximizes the profit of the concern. The Ultimate aim of the business concern is earning profit, hence, it considers all the possible ways to increase the profitability of the concern. Profit is the parameter of measuring the efficiency of the business concern. So it shows the entire position of the business concern. and hence Profit maximization objectives help to reduce the risk of the business. Its main aim is to earn profit. In this criteria Profit is the main parameter of business operation. It reduces the risk of business concern. In this criteria profit is the main source of finance and profitability meets the social needs.

Some of the unfavorable arguments of profit maximizations are that it leads to exploiting workers and consumers. It also creates immoral practices such as corrupt practice, unfair trade practice, etc. It also creates inequalities among the stake holders such as customers, suppliers, public shareholders, etc.

Some of the drawbacks of profit maximizations are

Advantages And Disadvantages Of Profit Maximization Pdf Download

- In Profit Maximization, profit is not defined precisely or correctly. It creates some unnecessary opinion regarding earning habits of the business concern. For example, profit may be long term or short term. It may be total profit or rate of profit. It may be net profit before tax or net profit after tax. It may be return on total capital employed or total assets or shareholders equity and so on.

- It ignores the time value of money:Profit maximization does not consider the time value of money or the net present value of the cash inflow. It leads certain differences between the actual cash inflow and net present cash flow during a particular period. When the profitability is worked out the bigger the better principle is adopted as the decision is based on the total benefits received over the working life of the asset, Irrespective of when they were received.

- It ignores the quality aspects of benefits which are associated with the financial course of action. The term 'quality' means the degree of certainty associated with which benefits can be expected. Therefore, the more certain the expected return, the higher the quality of benefits. As against this, the more uncertain or fluctuating the expected benefits, the lower the quality of benefits.

- It ignores risk: Profit maximization does not consider risk of the business concern. Risks may be internal or external which will affect the overall operation of the business concern.

Advantages And Disadvantages Of Profit Maximization Pdf Free

Wealth Maximization: Wealth maximization is one of the modern approaches, which involves latest innovations and improvements in the field of the business concern. The term wealth means shareholder wealth or the wealth of the persons those who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business. It removes technical disadvantages of the profit maximization. Wealth maximization is superior to the profit maximization because the main aim of the business concern under this concept is to improve the value or wealth of the shareholders. Wealth maximization considers the comparison of the value to cost associated with the business concern. Total value detected from the total cost incurred for the business operation. It provides extract value of the business concern. This concept considers both time and risk of business concern. This criteria provides efficient allocation of resources and it also ensures the economic interest of the society. The wealth maximization criterion is based on cash flows generated and not on accounting profit. The computation of cash inflows and cash outflows is precise. Wealth maximization can be activated only with the help of the profitable position of the business concern. So The goal of maximizing the value of the stock avoids the problems associated with the different goals we discussed above.in a simple language a good financial decisions increase the market value of the owners’ equity and poor financial decisions decrease it. So the financial manager best serves the owners of the business by identifying goods and services that add value to the firm because they are desired and valued in the free marketplace. So it is a long term concept based on the cash flows rather than profits and hence there can be a situation where a business makes losses every year but there are cash profits because of heavy depreciation which indirectly suggests heavy investment in fixed assets and that is the real wealth and it takes into account the time value of money and so is universally accepted.